| Sanankoro Gold Project | |

|---|---|

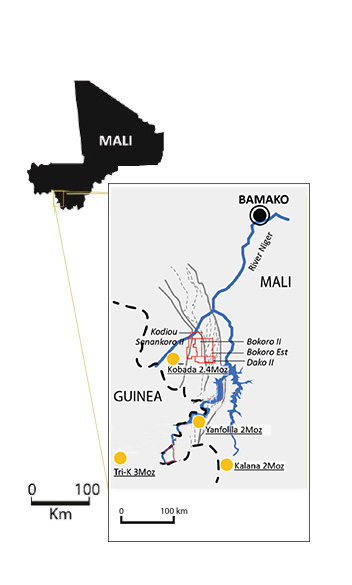

| Location | Yanfolila Gold Belt, south Mali |

| Project Area | Five contiguous permits (Bokoro II, Bokoro Est, Dako II, Kodiou & Sanankoro II) covering approximately 342 sq km |

| Gold Mineralisation | Oxides up to 207m depth & high-grade sulphides identified at depth |

| DFS & Optimised Project Economics (2022) |

(based on a gold price of US$1,750/oz; announcement 21 November 2022) Updated DFS due 2025 |

| Maiden Probable Reserve (2022) | 10.1 Mt at 1.30 g/t Au for 422 koz

(based on a gold price of US$1,650/oz; announcement 21 November 2022) |

| Mineral Resource Estimate (2024) | 31.4 Mt at 1.04 g/t Au for 1,044 koz, comprising:

(based on a gold price of US$2,400/oz; cut-off grade 0.3 g/t Au; announcement 15 January 2025) |

| Additional Exploration Target (2022) | 26.0-35.2 Mt at 0.58-1.21 g/t Au for 490-1,370 koz

(announcement 07 November 2022) |

Click here for an overview of the Sanankoro Project Area / Sanankoro Gold Project as at May 2025.

Sanankoro Timeline

Sanankoro Financing

In 2023 Cora appointed Atlantique Finance as its sole adviser in the structuring & mobilisation of a medium-term US$70m loan, which will be used to support all aspects of the development & construction of the Sanankoro Gold Mine.